Karburator adalah salah satu bagian kunci dalam mesin pembakaran dalam yang memiliki peran vital dalam mengatur campuran udara dan bahan bakar. Dalam artikel ini, kita akan mengungkap sejarah, perkembangan, serta peran dan dampak karburator dalam sejarah mesin.

Awal Mula

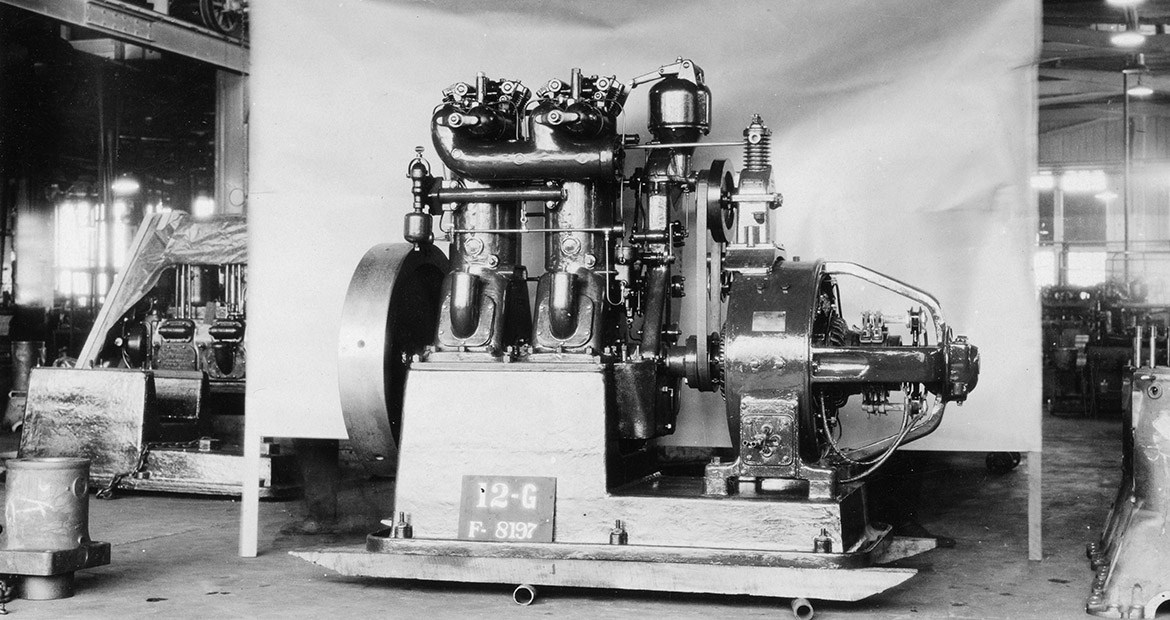

- Penemuan Pertama: Karburator pertama kali dikembangkan pada akhir abad ke-19. Dikembangkan sebagai solusi untuk mengatur campuran udara dan bahan bakar dalam mesin pembakaran dalam.

- Inovator Awal: Penemu utama karburator termasuk Gottlieb Daimler, Karl Benz, dan Wilhelm Maybach. Mereka merintis penggunaan karburator dalam kendaraan bermesin bensin pertama.

Fungsi dan Prinsip Kerja

- Regulasi Campuran: Karburator mengatur campuran udara dan bahan bakar yang tepat untuk pembakaran yang efisien dalam ruang bakar mesin.

- Venturi Effect: Prinsip kerja karburator didasarkan pada efek Venturi. Di mana aliran udara yang berkecepatan tinggi menciptakan tekanan rendah yang menarik bahan bakar ke dalam aliran udara.

Perkembangan Awal

- Karburator Sederhana: Karburator awal relatif sederhana, menggunakan prinsip flot sederhana untuk mengendalikan ketinggian bahan bakar dalam bak karburator.

- Penyesuaian Manual: Pengendalian campuran udara dan bahan bakar pada karburator awal dilakukan secara manual oleh pengemudi dengan menggunakan tuas atau tombol.

Peran dalam Revolusi Otomotif

- Pertumbuhan Industri Otomotif: Karburator menjadi komponen kunci dalam mesin-mesin bensin pada awal industri otomotif. Karburator memungkinkan mobil untuk menjadi kendaraan yang lebih praktis dan mudah dioperasikan.

- Evolution Karburator: Seiring dengan perkembangan industri otomotif, karburator mengalami evolusi dan perbaikan. Termasuk penambahan choke untuk memulai mesin dengan lebih mudah dan pengendalian otomatis yang lebih canggih.

Dampak Teknologi Modern

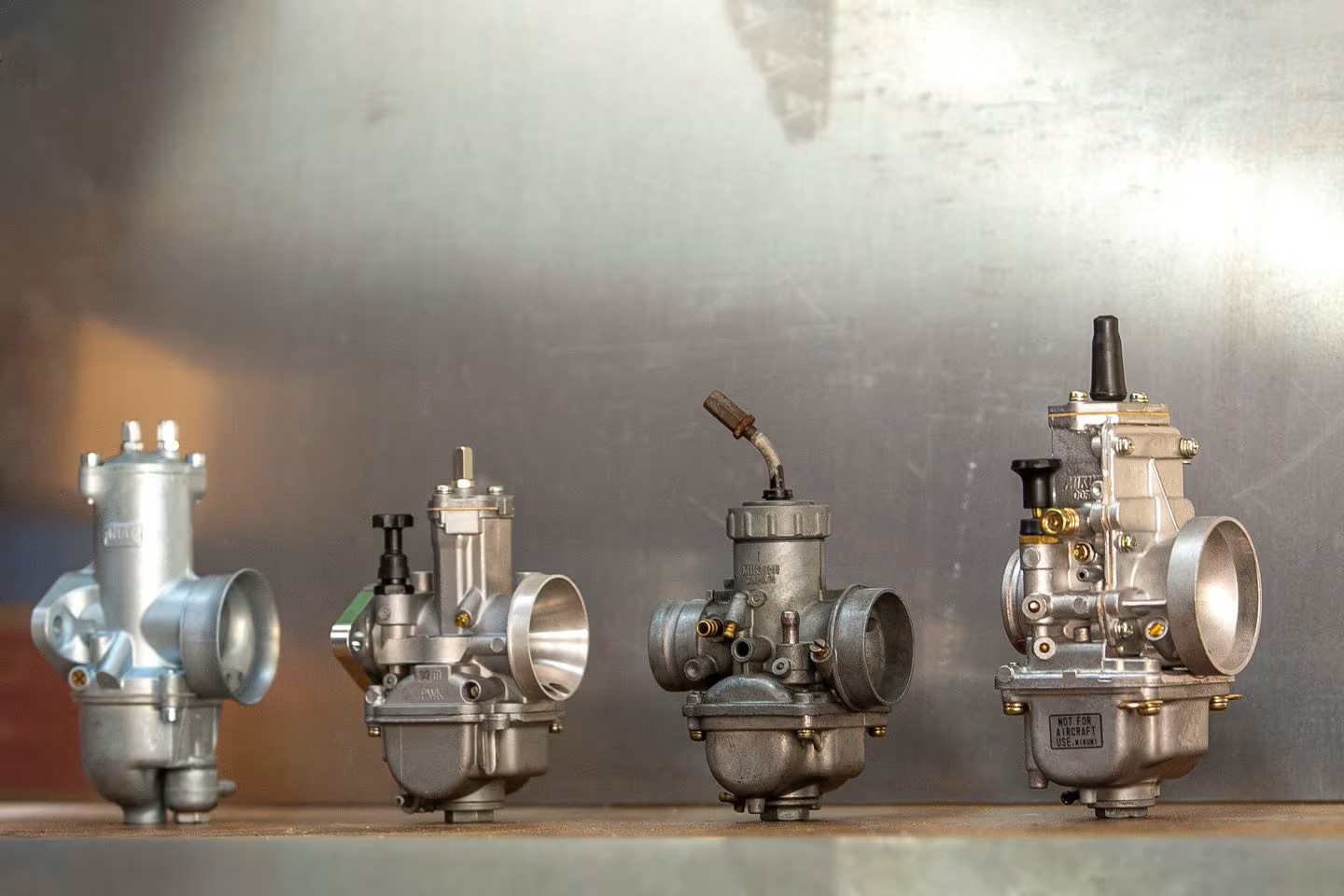

- Penurunan Penggunaan: Dengan munculnya teknologi injeksi bahan bakar yang lebih canggih, penggunaan karburator secara bertahap menurun dalam kendaraan bermesin bensin modern.

- Kendaraan Klasik dan Kustom: Namun, karburator masih digunakan secara luas dalam kendaraan klasik, mobil balap, dan kendaraan kustom yang mempertahankan estetika dan karakteristik mesin tradisional.

Warisan dan Signifikansi

Karburator memiliki warisan yang penting dalam sejarah mesin pembakaran dalam. Menjadi salah satu inovasi kunci yang memungkinkan revolusi otomotif yang mengubah cara kita bergerak dan transportasi di seluruh dunia. Meskipun penggunaannya semakin tergantikan oleh teknologi injeksi bahan bakar modern, peran dan kontribusi karburator dalam sejarah teknologi dan transportasi tetap menjadi bagian yang tak terpisahkan dari evolusi mesin pembakaran dalam.